Bagley Risk Management : Protecting Your Service Future

Bagley Risk Management : Protecting Your Service Future

Blog Article

Recognizing Animals Threat Defense (LRP) Insurance: A Comprehensive Overview

Browsing the world of animals threat defense (LRP) insurance coverage can be a complex endeavor for numerous in the farming field. From how LRP insurance policy functions to the numerous insurance coverage alternatives readily available, there is much to uncover in this extensive guide that could possibly form the means animals producers approach threat management in their businesses.

Exactly How LRP Insurance Functions

Occasionally, understanding the mechanics of Animals Threat Security (LRP) insurance can be complicated, however breaking down just how it functions can supply clearness for breeders and farmers. LRP insurance is a risk management device designed to safeguard animals producers versus unforeseen rate decreases. It's essential to keep in mind that LRP insurance policy is not an earnings warranty; instead, it concentrates only on cost risk defense.

Eligibility and Coverage Options

When it comes to insurance coverage alternatives, LRP insurance coverage provides manufacturers the flexibility to choose the coverage level, coverage period, and recommendations that ideal match their risk management requirements. By comprehending the qualification criteria and coverage options available, animals producers can make informed choices to take care of risk successfully.

Benefits And Drawbacks of LRP Insurance Coverage

When evaluating Animals Danger Protection (LRP) insurance policy, it is vital for animals producers to evaluate the benefits and negative aspects fundamental in this threat management device.

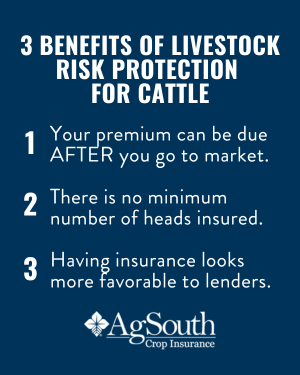

Among the main advantages of LRP insurance is its capability to give security versus a decline in livestock rates. This can assist guard manufacturers from economic losses arising from market changes. Additionally, LRP insurance coverage offers a level of flexibility, enabling producers to tailor insurance coverage levels and policy durations to match their specific requirements. By securing a guaranteed cost for their animals, producers can much better manage threat and plan for the future.

Nevertheless, there are additionally some drawbacks to consider. One constraint of LRP insurance coverage is that it does not secure against all types of threats, such as disease break outs or natural disasters. Costs can in some cases be expensive, especially for manufacturers with big livestock herds. It is important for producers to meticulously analyze click for more their specific threat direct exposure and monetary situation to figure out if LRP insurance coverage is the right risk management device for their operation.

Recognizing LRP Insurance Policy Premiums

Tips for Maximizing LRP Benefits

Taking full advantage of the advantages of Animals Danger Defense (LRP) insurance policy calls for calculated planning and positive risk management - Bagley Risk Management. To take advantage of your LRP insurance coverage, think about the adhering to ideas:

Frequently Examine Market Conditions: Keep notified regarding market patterns and cost changes in the livestock industry. By checking these aspects, you can make enlightened choices regarding when to purchase LRP coverage to protect against potential losses.

Establish Realistic Coverage Levels: When selecting coverage levels, consider your production expenses, market price of livestock, and possible threats - Bagley Risk Management. Establishing sensible coverage degrees makes sure that go to this site you are sufficiently shielded without paying too much for unneeded insurance coverage

Diversify Your Insurance Coverage: Rather of relying solely on LRP insurance coverage, think about diversifying your risk management approaches. Incorporating LRP with other danger administration tools such as futures agreements or options can give thorough insurance coverage against market uncertainties.

Testimonial and Adjust Coverage Routinely: As market conditions transform, occasionally evaluate your LRP protection to ensure it straightens with your existing risk direct exposure. Adjusting coverage degrees and timing of acquisitions can help maximize your risk security technique. By adhering to these ideas, you can make best use of the advantages of LRP insurance and secure your livestock operation against unforeseen threats.

Final Thought

To conclude, animals threat protection (LRP) insurance coverage is a valuable tool for farmers to take care of the economic threats connected with their animals operations. By recognizing exactly how LRP functions, eligibility and protection options, along with the benefits and drawbacks of this insurance coverage, farmers can make informed choices to secure their incomes. By very carefully considering LRP costs and executing strategies to make best use of advantages, farmers can mitigate prospective losses and ensure the sustainability of their procedures.

Animals manufacturers interested in obtaining Animals Threat Protection (LRP) insurance coverage can discover a range of eligibility standards and coverage options tailored to their particular animals operations.When it comes to protection alternatives, LRP insurance policy provides manufacturers the versatility to choose the protection level, coverage duration, and recommendations that ideal fit their threat management requirements.To understand the ins and outs of Animals Threat Protection (LRP) insurance policy completely, comprehending the aspects influencing LRP insurance coverage costs is important. LRP insurance policy premiums are established by various elements, consisting of the protection hop over to these guys level picked, the expected rate of animals at the end of the insurance coverage duration, the type of animals being insured, and the size of the insurance coverage period.Review and Adjust Insurance Coverage Frequently: As market problems transform, regularly assess your LRP coverage to guarantee it aligns with your current threat exposure.

Report this page